Share

(www.investorideas.com

Newswire) Silver is now moving back and forth intraday by as much as

it was trading just 15 years ago…

But while we’re looking at the short-term price moves,

let’s not forget about the big picture.

It’s not good to miss the forest while looking at trees.

And the big picture is this:

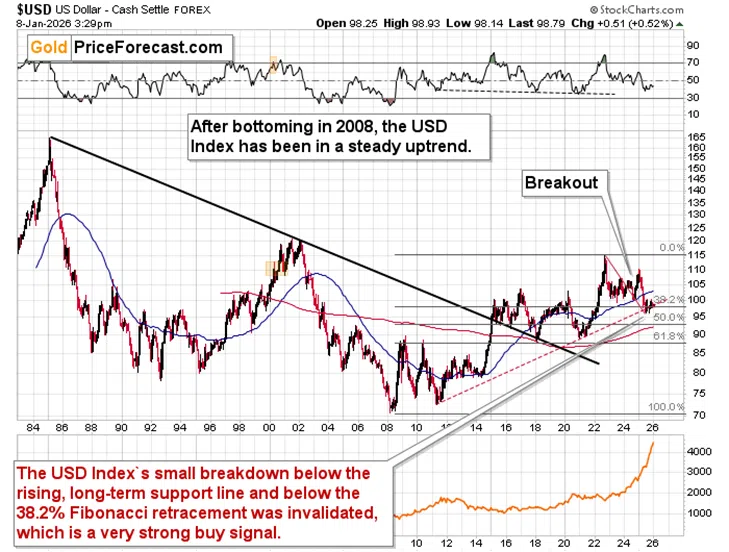

The USD Index has been declining in recent years, but the reality is

that it’s after a very long-term breakout that materialized in

early 2015 and that was then verified in the following years.

Believe it or not, the USD Index has been in a long-term uptrend since

2008.

Yes, the precious metals sector managed to move higher despite that,

as it has other drivers in addition to the USD Index, but please note

what happened when the USD Index was launching its 2014-2015 and 2021

rallies. That’s when gold not only stopped rallying, but it actually declined.

The fact that the USD Index moved back to its rising, red support line

and at the same time it stopped declining close to its 38.2% Fibonacci retracement strongly suggests that we’re about to see another sizable

upswing – one similar to those that previously triggered big

declines in the precious metals sector.

That’s the forest – let’s keep it in mind.

Zooming in reveals that the USD Index keeps on climbing. It’s

been rallying since late December, and it’s up in 2026.

The April 2025 bottom held.

It looks like we’re seeing the beginning of another big move

higher in the value of the U.S. currency.

PMs and miners are down today, but nothing extraordinary YET.

As the geopolitically-driven safe-haven buying fades, the market is

likely to look back at the USD Index – and PMs and miners would

be likely to decline. Silver has a unique fundamental situation, but it’s unlikely to break higher now if the CME keeps

raising margins for silver futures.

Thank you for reading today’s free analysis. If enjoyed it and

would like to get the follow-ups, I encourage you to sign up for my free gold newsletter today.

Thank you.

Przemyslaw K. Radomski, CFA

Founder

Golden Meadow®

Exploring Mining Podcast with Investorideas – get mining stock news

from TSX, TSXV, CSE, ASX, NASDAQ, NYSE companies plus interviews

with CEO’s and leading experts

Check out the

Exploring Mining podcast

at Investorideas.com with host Cali Van Zant for the latest mining

stock news and insightful interviews with top industry experts

Latest episode: https://www.youtube.com/watch?v=YRNGJcKykJQ

Research mining stocks at Investorideas.com free stock directory

https://www.investorideas.com/Gold_Stocks/Stocks_List.asp

Sign up for free stock news alerts at Investorideas.com:

https://www.investorideas.com/Resources/Newsletter.asp

About Investorideas.com – Big Investing Ideas

Investorideas.com

is the go-to platform for big investing ideas. From breaking stock

news to top-rated investing podcasts, we cover it all.

Mining stocks -Learn more about our news, PR and social media,

podcast and content services at Investorideas.com

https://www.investorideas.com/Investors/Services.asp

Follow us on X @investorideas @stocknewsbites

Follow us on

Facebook

https://www.facebook.com/Investorideas

Follow us on YouTube

https://www.youtube.com/c/Investorideas

Contact Investorideas.com

800 665 0411

This is not investment opinion. Our site does not make recommendations

for purchases or sale of stocks, services or products. Nothing on our

sites should be construed as an offer or solicitation to buy or sell

products or securities. All investing involves risk and possible losses.

This site is currently compensated for news publication and

distribution, social media and marketing, content creation and more.

Learn more about publishing your news release and our other news

services on the Investorideas.com newswire