Share

(www.investorideas.com

Newswire) Silver has crossed $100 for the first time in history. That

sentence alone should tell you everything about where we are.

When I published Issue #5 of the

Silver Catalyst

on January 13, silver had just surged above $88 following the

Department of Justice’s unprecedented investigation into Fed Chair

Jerome Powell. In the two weeks since, the metal tested $100 on

January 23, retreated briefly, and on January 26 exploded to $117.75

intraday as gold shattered the $5,000 barrier for the first time in

history.

If you positioned in

silver throughout 2025, you’ve now witnessed a move that will be discussed in financial

history books for generations. A 290%+ gain year-over-year. From $29

to $117. The gold-silver ratio has compressed from 100:1 in April 2025

to approximately 45:1 today. That compression alone represents one of

the most dramatic precious metals realignments in modern markets.

The catalyst? Some of the forces identified in

“Silver Rising”

have not merely materialized. They have converged with an intensity

that exceeded even the most bullish scenarios. China’s export

restrictions have fragmented global supply. COMEX inventories are

hemorrhaging. Physical premiums in Shanghai reached $5-8 per ounce

over Western benchmarks. The Federal Reserve’s independence is under

direct assault. And industrial demand from solar, EVs, AI,

semiconductors, 5G infrastructure, and space technology continues

consuming silver faster than miners can extract it from the earth.

This is the fifth consecutive year of structural deficits,

projected

to extend into a sixth. The cumulative drain has now approached 820

million ounces since 2021. The math has become destiny.

The Two Weeks That Made History

In the span of just 14 days, the silver market experienced:

- The first $100+ print in silver history (January 23)

- Gold breaking $5,000 for the first time (January 26)

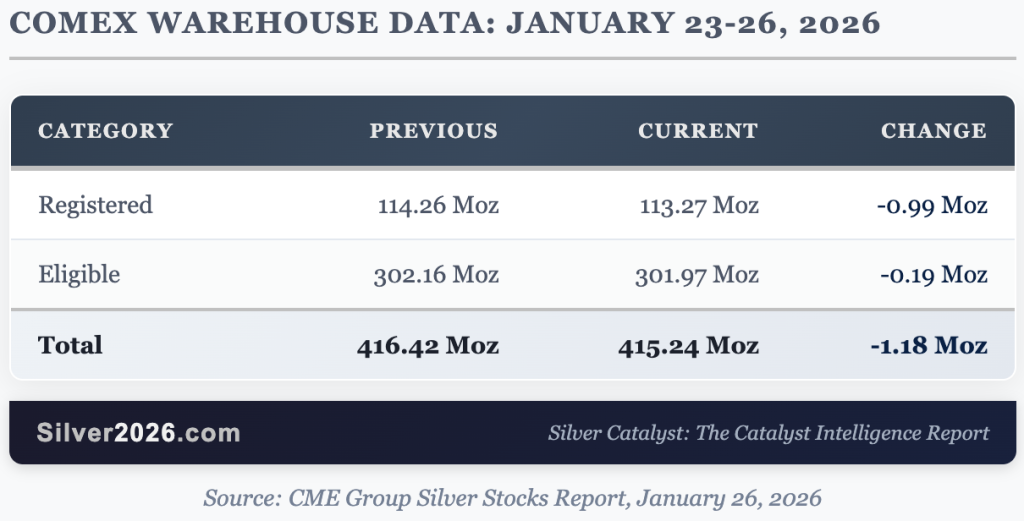

- COMEX registered inventory falling to 113.27 million ounces

- The gold-silver ratio compressing to 45:1 (lowest since 2011)

- Sprott PSLV doubling its ATM program to $2 billion

-

Shanghai physical premiums reaching $5-8/oz over Western benchmarks -

44 Indian trading firms in Rajkot declaring insolvency from being

caught short

The structural forces driving silver’s transformation have not merely

accelerated. They have reached a point where paper and physical

markets can no longer maintain the pretense of unity.

There are ten Deep Dives that I’m discussing in this week’s premium

Silver Catalyst

issue, and in this free article, I’ll discuss three of them.

The Data

The January 23-26 COMEX warehouse report reveals continuing inventory

stress:

The Context

During the first week of January 2026, COMEX warehouses experienced a

33.45-million-ounce withdrawal in just seven days,

representing 26% of registered inventory vanishing in a single week.

January 7 data revealed JP Morgan issuing 99% of 8.1 million ounces in

delivery notices through 1,624 contracts. What made this unusual?

January open interest increased by 1,431 contracts despite

these deliveries.

The backward rolling pattern that emerged speaks volumes about market

psychology. Traders are rolling contracts

from March back to January and February for immediate

delivery rather than waiting. This is the opposite of normal market

behavior and signals urgent demand for immediate physical metal.

The Paper-to-Physical Ratio

The paper-to-physical ratio measures how many ounces of “paper silver”

(futures contracts, derivatives) exist for every ounce of physical

metal available for delivery. At its historical peak, this ratio

reached approximately 356:1, meaning 356 paper ounces

existed for every physical ounce in registered vaults.

Today, the

March 2026 futures contract

alone represents 528 million ounces of exposure

(105,683 contracts × 5,000 oz) against only 113 million ounces

of registered silver. That is more than 4x the deliverable supply

concentrated in a single contract month.

Catalyst Connection: This validates

Catalyst #2: COMEX Inventory Depletion Creating Delivery

Crisis

from

“Silver Rising.”

The ratios have now deteriorated far beyond what I described when

writing the book.

Deep Dive #3: The Stanford Breakthrough That Could Transform

Silver’s Future

What Happened

In Issue #4 (this issue is available free), I discussed Samsung’s

solid-state battery program

and its potential implications for silver demand. The Stanford

research published January 16 in

Nature Materials

takes this story significantly further.

Stanford researchers demonstrated that a nanoscale silver coating can

solve the cracking problem that has plagued solid-state batteries.

Silver-treated solid electrolyte surfaces become

5x more resistant to lithium intrusion damage,

achieved by heat-treating a mere 3-nanometer silver layer that allows

silver ions to replace lithium atoms 20-50 nanometers below the

surface.

Why This Matters

Current lithium-ion EVs use 25-50 grams of silver per

vehicle. Industry estimates suggest Samsung’s solid-state batteries

could require approximately

1 kilogram of silver per 100 kWh battery pack, based

on ~5 grams per cell across ~200 cells per pack. Samsung’s solid-state

battery program uses a silver-carbon (Ag-C) composite anode promising

600-mile range and 9-minute 80% charging. BMW is partnering with

Samsung for next-generation evaluation vehicles in late 2026.

Sources:

Batteries News,

Discovery Alert

The Demand Math

At 50% solid-state battery adoption, automotive silver demand alone

would exceed current total industrial demand. This is a potential

order-of-magnitude transformation in the demand

picture. The timeline remains uncertain (Toyota targets production

2027-2028), but the directional implications are extraordinary.

Why does it matter? If solid-state batteries achieve

even 20% EV market penetration by 2030, that’s 514 million ounces of

new annual demand, roughly equal to the current annual industrial

consumption. This isn’t a marginal increase. It’s a potential doubling

of industrial silver demand from a single application. The Stanford

research moves this from “interesting lab concept” to “engineering

problem being solved.”

Catalyst Connection: This validates

Catalyst #80: Solid-State Batteries Requiring Enhanced Silver

Content

from

“Silver Rising.”

Deep Dive #9: Sprott Doubles Down with $2 Billion

The Announcement

On January 20, 2026, Sprott Physical Silver Trust (PSLV) announced it

had updated its at-the-market equity program to issue up to

$2.0 billion of units, doubled from the $1 billion

announced December 11, 2025. Proceeds will fund physical silver

bullion acquisition.

Source:

Sprott Press Release, January 20, 2026

What This Signals

At current silver prices (~$110/oz), $2 billion could acquire

approximately 18 million ounces of physical silver.

This represents roughly 16% of current COMEX registered inventory.

Sprott is effectively signaling that institutional demand for

allocated physical silver justifies this scale of capital deployment.

ETF Flow Summary

The divergence is notable: SLV experienced profit-taking outflows

while PSLV and SIVR attracted capital. This may reflect investor

preference for funds perceived to have more direct physical backing.

Why does it matter? Sprott doubling its capital raise

capacity to $2 billion signals institutional conviction about physical

silver’s value proposition. At ~$110/oz, that’s approximately 18

million ounces of buying power, equivalent to 16% of COMEX registered

inventory. When institutions compete for physical metal at this scale,

they’re betting that paper claims will continue losing credibility

relative to allocated bullion. The divergence between SLV outflows and

PSLV/SIVR inflows suggests sophisticated investors are distinguishing

between types of silver exposure.

Catalyst Connection: This validates

Catalyst #52: SLV Inflows Exceed $2.5 Billion as Regional

Divergence Became Global Convergence

from

“Silver Rising.”

The ETF story has evolved from regional divergence to coordinated

global accumulation.

The Outlook

Silver has almost reached my $120 target from Issue

#5, with the January 26 intraday high of $117.75. After a move of this

magnitude, a decline or consolidation would be normal and healthy.

Markets don’t move in straight lines, and

profit-taking after a 290%+ year is to be expected.

That said, the

fundamental picture remains exceptional. The

structural deficit continues into its fifth year. China’s export

restrictions took effect January 1 and have not been reversed. COMEX

inventories keep falling. Physical premiums in Asia remain elevated.

The Fed independence crisis creates ongoing monetary uncertainty. And

the industrial demand story, from solar to EVs to AI to solid-state

batteries, keeps strengthening.

This is a once-in-a-generation opportunity in the silver market. The

convergence of supply constraints, industrial demand growth, and

monetary instability that I outlined in

“Silver Rising”

is playing out faster and more intensely than even the bullish

scenarios suggested. The full Issue #6 contains seven more Deep Dives

covering solar thrifting, the physical market fracture, India’s demand

surge, semiconductor capex, 5G infrastructure, space technology, and

the Fed crisis, plus the complete Catalyst Dashboard and institutional

price forecasts. If you want to understand where this market is headed

and stay informed as it unfolds, I encourage you to

get “Silver Rising” with complimentary 2-week access to the Silver

Catalyst newsletter.

Thank you.

Przemyslaw K. Radomski, CFA

Founder

Golden Meadow®

Exploring Mining Podcast with Investorideas – get mining stock news

from TSX, TSXV, CSE, ASX, NASDAQ, NYSE companies plus interviews

with CEO’s and leading experts

Check out the

Exploring Mining podcast

at Investorideas.com with host Cali Van Zant for the latest mining

stock news and insightful interviews with top industry experts

Latest episode: https://www.youtube.com/watch?v=iGGmmWOZPPQ

Research mining stocks at Investorideas.com free stock directory

https://www.investorideas.com/Gold_Stocks/Stocks_List.asp

Sign up for free stock news alerts at Investorideas.com:

https://www.investorideas.com/Resources/Newsletter.asp

About Investorideas.com – Big Investing Ideas

Investorideas.com

is the go-to platform for big investing ideas. From breaking stock

news to top-rated investing podcasts, we cover it all.

Mining stocks -Learn more about our news, PR and social media,

podcast and content services at Investorideas.com

https://www.investorideas.com/Investors/Services.asp

Follow us on X @investorideas @stocknewsbites

Follow us on

Facebook

https://www.facebook.com/Investorideas

Follow us on YouTube

https://www.youtube.com/c/Investorideas

Contact Investorideas.com

800 665 0411

This is not investment opinion. Our site does not make recommendations

for purchases or sale of stocks, services or products. Nothing on our

sites should be construed as an offer or solicitation to buy or sell

products or securities. All investing involves risk and possible losses.

This site is currently compensated for news publication and

distribution, social media and marketing, content creation and more.

Learn more about publishing your news release and our other news

services on the Investorideas.com newswire