Don’t miss an episode of our podcast, Personal Finance for Long-Term Investors. Tune in on:

Now, here’s today’s article:

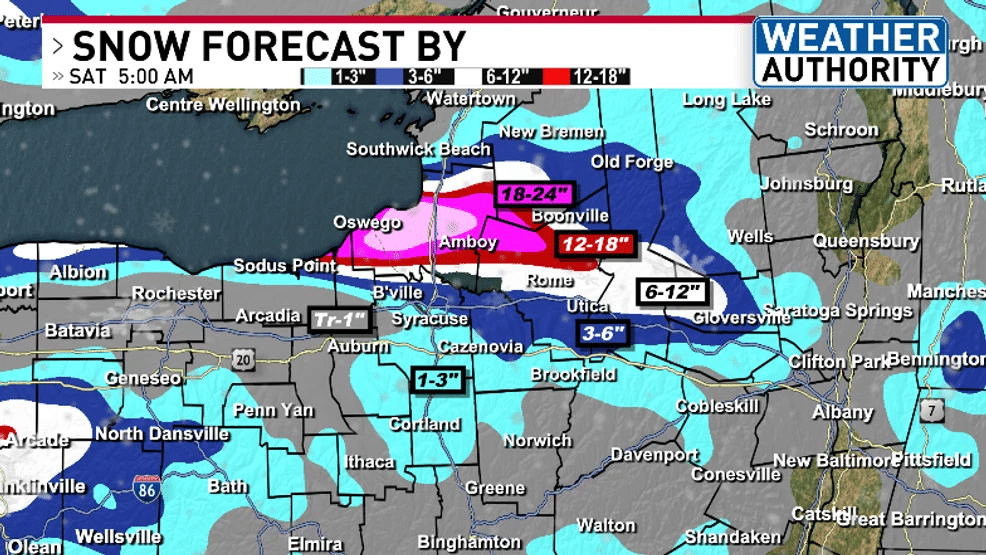

My parents’ home is getting ~12 inches of snow over the next 24 hours. My friends’ childhood homes, just a few miles away, are getting 24+ inches of snow. In one day!

On the map below, my childhood home is ~1 mile east of the “t” in Sodus Point. Many of my friends grew up a few miles north of the “n” and “t”, in the red and pink bands of snowfall.

So it goes for the lake effect snow belts in Upstate NY.

If you’re commuting to work, running to the grocery store, or planning a picnic, a daily weather forecast is essential. You care about today’s prediction, regardless of any long-term average.

But are there people for whom the opposite is true? People for whom today doesn’t matter, but the next 30 years’ weather is vital?

Let’s reimagine meteorology for a second. Instead of daily forecasts, what if we had a multi-decade forecast? Would you care about average temperatures, average rainfalls, average windy days for the next 30 years?

Farmers and agricultural planners would care. Crop selection, irrigation systems, and land purchases are decadal bets.

City planners and engineers would care. Roads, bridges, drainage systems, seawalls, power grids. You design infrastructure for long-term averages and extremes.

Insurance companies would care. They price risk over long horizons. Flood risk. Fire risk. Storm frequency.

Energy producers would care. Solar, wind, hydro, and grid capacity planning all depend on long-run climate expectations.

Governments and pension systems would care. Disaster preparedness, budgeting, population migration, long-term fiscal stress.

Anyone with a large, slow-moving decision would care.

2026 Stock Market Forecasts

The annual stock market forecasts are out, reading the tea leaves for the next 12 months.

Even if those forecasters were as accurate as the daily weather, which they’re not, you shouldn’t care.

As long-term investors, we have a large, slow-moving decision in front of us. We have decadal decisions.

We don’t need daily, weekly, monthly, or even annual market forecasts.

When it comes to stocks and the stock market, you should care about decades.

If you really care about 2026 – perhaps because you need one year of living expenses from your portfolio this year – that money shouldn’t be in stocks. That money should be invested in something you can predict this year, like cash or 1-Year Treasury bonds.

It’s really as simple as that.

Some related articles:

Thank you for reading! Here are three quick notes for you:

First – If you enjoyed this article, join 1000’s of subscribers who read Jesse’s free weekly email, where he send you links to the smartest financial content I find online every week. 100% free, unsubscribe anytime.

Second – Jesse’s podcast “Personal Finance for Long-Term Investors” has grown ~10x over the past couple years, now helping ~10,000 people per month. Tune in and check it out.

Last – Jesse works full-time for a fiduciary wealth management firm in Upstate NY. Jesse and his colleagues help families solve the expensive problems he writes and podcasts about. Schedule a free call with Jesse to see if you’re a good fit for his practice.

We’ll talk to you soon!